Four Surprising Steps On How To Control Your Cash

By: Ermz

Four Surprising Steps On How To Control Your Cash

Are you the one who control your cash?

Or your cash is the one who controls you?

How do you manage your finances so that you can multiply it?

Do you believe that in this world, there is no shortage of blessings, but most of the time we failed to see it? Let’s have some lessons from the little ants.

In Proverbs 6:6 says, “Take a lesson from the ants and learn from their ways and become wise. They labour hard all summer gathering food for the winter.” Can we be wise like the ants, who gather food during summer so that there is food when winter comes?

Have you observe them how they be able to do it?Maybe it’s hard for them too, but they never waver because they are very focused on their goal, that is to gather food as much as they can… preparing for time when they don’t have the chance do it. Like the ants, we too have the capacity to focus on our goal and prepare for our future.Did it ever cross your mind that living too long is a burden if you are not financially healthy? So how do we prepare for it? What are the things that need to be done? These four tips that I would like to share with you were one of the learning’s that I learned from my mentor, Bo Sanchez.1. Stop borrowing

Have you observe them how they be able to do it?Maybe it’s hard for them too, but they never waver because they are very focused on their goal, that is to gather food as much as they can… preparing for time when they don’t have the chance do it. Like the ants, we too have the capacity to focus on our goal and prepare for our future.Did it ever cross your mind that living too long is a burden if you are not financially healthy? So how do we prepare for it? What are the things that need to be done? These four tips that I would like to share with you were one of the learning’s that I learned from my mentor, Bo Sanchez.1. Stop borrowing2. Protect your asset

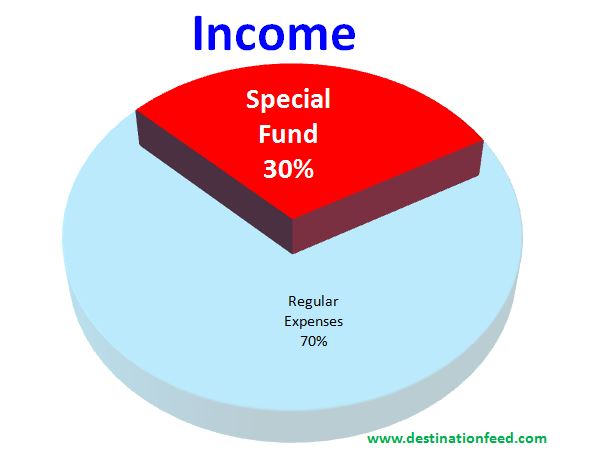

3. Live on 70% of your income

4. Set aside 30% or more of your income for special fund

Let’s start:

1. Stop Borrowing

Here we go:

- List down all your payables.

- Identify the short-term and long-term loans.

- Determine which one to go first – should be with high interest, then which debt that you can ask for reprieve for at least 3-months to a year as you work through your added sources of income until everything is settled.

- Compare your income and expenses. Which is higher?

- If the expenses is higher… cut what is needed to cut. Find other source of income to augment the over expenses which need regular funding.

Do you know the secret of Credit Cards Company? They want you to borrow. Cash advance is easy to do with your card :). And they want you to pay only the minimum because they are earning as much as 42% from interest every year, not including the late fee here.

But here it is, the giant screen enticing you for easy payment instalment plan with zero interest. Can you give in or not? Can you really manage it?

Late bills payment can cause tensions, sleepless nights and more. Think hard. Stop borrowing now.

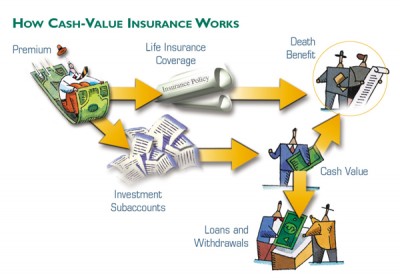

2. Protect Your Asset

Does your home covered by insurance?Were you ensured?What if something that we did not expect, happen?Unexpected event happens in a blink of an eye, calamities are in normal occurrence nowadays, and insuring our properties will unburden us for financial difficulty later on.I am not a believer of insurance policy before, but now I appreciate its purpose.Look for an insurance company with solid business portfolio. Ask and learn from someone who knows the business by heart.

3. Live in 70% of your Income

Now you would ask me, how in the world I could live in 70% of my income, if right now I am leaving in 120 to 150%.

Simple as it is, you spend more than what you earn.

On my part, I spend it on paying off debts. But your goal now is to control your cash in order for you to manage what you earn. The little expenses that you spend each day, that you can’t control goes just like a passing wind. Now, you have money in your wallet, in a few minutes or less if you are in a shopping mall, it can be gone and here you are broke, for the next few days until another pay check arrives. Your recourse again is to borrow. But, remember our number one rule, “Stop borrowing”. Of course borrowing to finance a business is a different one.

Did it ever occur in your mind for a minute that through these controllable little expenses, millions had pass in your hands and you just let it simply pass. You are throwing away millions. (Will write more of these on the incoming Ebook-here you will know your controllable expenses and convert this to create millions. ). If I only learned this earlier in my life… I could possibly be a multi-millionaire as of this writing. But then, trouble comes, but there is always the opportunity to start again and end it big.

4. Set aside 30% or more for your special funds

Why do we need to do this?When I found myself in huge debt, it’s because I did not set aside any funds for special or emergency needs. (More of these; in another post – see link below). So, when my mother got sick, my recourse is to borrow money.Setting aside a portion of your income for special fund is a struggle for a start. But if you are determined enough to change your life for the better, disciplining yourself faithfully to do this would have its reward later. Then you would fully understand the law of “delaying gratification.”Decide now.Start right away.

Why do we need to do this?When I found myself in huge debt, it’s because I did not set aside any funds for special or emergency needs. (More of these; in another post – see link below). So, when my mother got sick, my recourse is to borrow money.Setting aside a portion of your income for special fund is a struggle for a start. But if you are determined enough to change your life for the better, disciplining yourself faithfully to do this would have its reward later. Then you would fully understand the law of “delaying gratification.”Decide now.Start right away.

Even billionaires control their cash, so you must be. Persevere with your goal until you are totally free from debts.

Make things happen.

No Comments