The Market Effects Of A Robust Carbon Tax

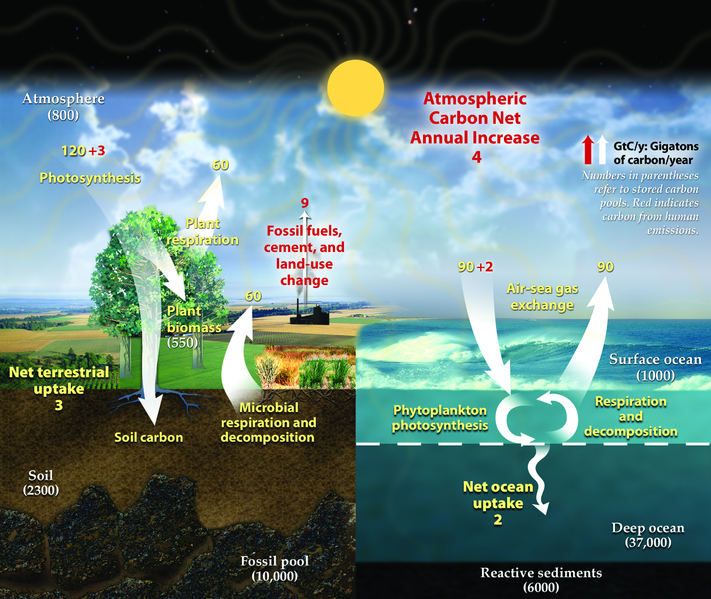

Photo Credit: wikipedia.org

Throughout the developed world, momentum is growing for major reductions in carbon emissions. As new research on climate change become public, people can more clearly see the potential dangers of unrestricted emissions. Fortunately, people from various political factions are increasingly working together to battle climate change. Carbon tax levies are controversial yet promising methods for producing immediate benefits to the natural environment. Every year, more and more economists agree that carbon taxes make good fiscal sense. While carbon taxes could cause some economic contraction in the short term, the medium to long-term benefits of robust carbon taxes are indisputable.

Typically, carbon taxes are levied on hydrocarbon fuels like coal, petroleum and natural gas. By raising the cost of using these ecologically harmful fuels, nations can encourage their people to use cleaner energy sources like wind and solar power. Robust carbon taxes also spur the development of new energy industries. Naturally, powerful industrial interest groups have every reason to fight carbon tax levies. Increasingly, these interest groups are failing in their efforts to influence public opinion.

To date, only a few nations have adopted comprehensive carbon taxes. Sweden, Norway and Switzerland are three nations with very robust carbon tax programs. Over the past fifteen years, these nations have experienced continued economic growth. Though variously affected by the global financial downturn, these ecologically conscious countries have seen remarkable financial stability. These carbon tax success stories are important case studies for nations currently considering similar tax measures.

Any new tax can precipitate a complex adjustment period for affected economies. However, economies are comprised of thinking human beings who are fully adaptable. Looking at the big picture, carbon taxes are necessary safeguards against the economic ravages of climate change. In the past few years, nations around the world have lost billions dealing with unusually violent weather patterns. While weather is naturally unpredictable, climatologists generally agree that carbon emissions are causing measurable harm.

In light of the potential economic consequences of rampant emissions, all developed nations should seriously consider carbon tax plans. In Canada, British Columbia has led the way by implementing a provincial carbon tax. While it has only been in place for a short time, this experiment has been quite a success. British Columbia now consumes fifteen percent less petroleum, which represents a great first step towards environmental protection. All the while, the province has seen enviable economic growth. In light of Canada’s environmental commitments, it is surprising that Canada has no national carbon tax. Contrary to the arguments of petroleum industry lobbyists, the majority of the Canadian public is conditionally ready for a robust carbon tax.

Most Canadians realize that a sensible carbon tax will produce direct and indirect benefits for the national economy through technology creating and increased investment opportunities. Before getting fully on board with such a tax, however, Canadians want to see greater efficiency and less waste in Ottawa and the provincial capitals. Overall, Canadians are happy to pay the cost to preserve Canada’s famous natural resources. However, the public has a long memory when it comes to scandal and malfeasance. If the Canadian government is going to collect enormous new revenues, they need to demonstrate their ability to use these revenues wisely. Since the eventual adoption of carbon taxes is fairly certain, individuals who invest in promising green energy firms may experience remarkable returns. Though individual energy stocks may experience damage from carbon tax levies, these levies should ultimately benefit the global economy.

Contributed By: Guest Author

No Comments